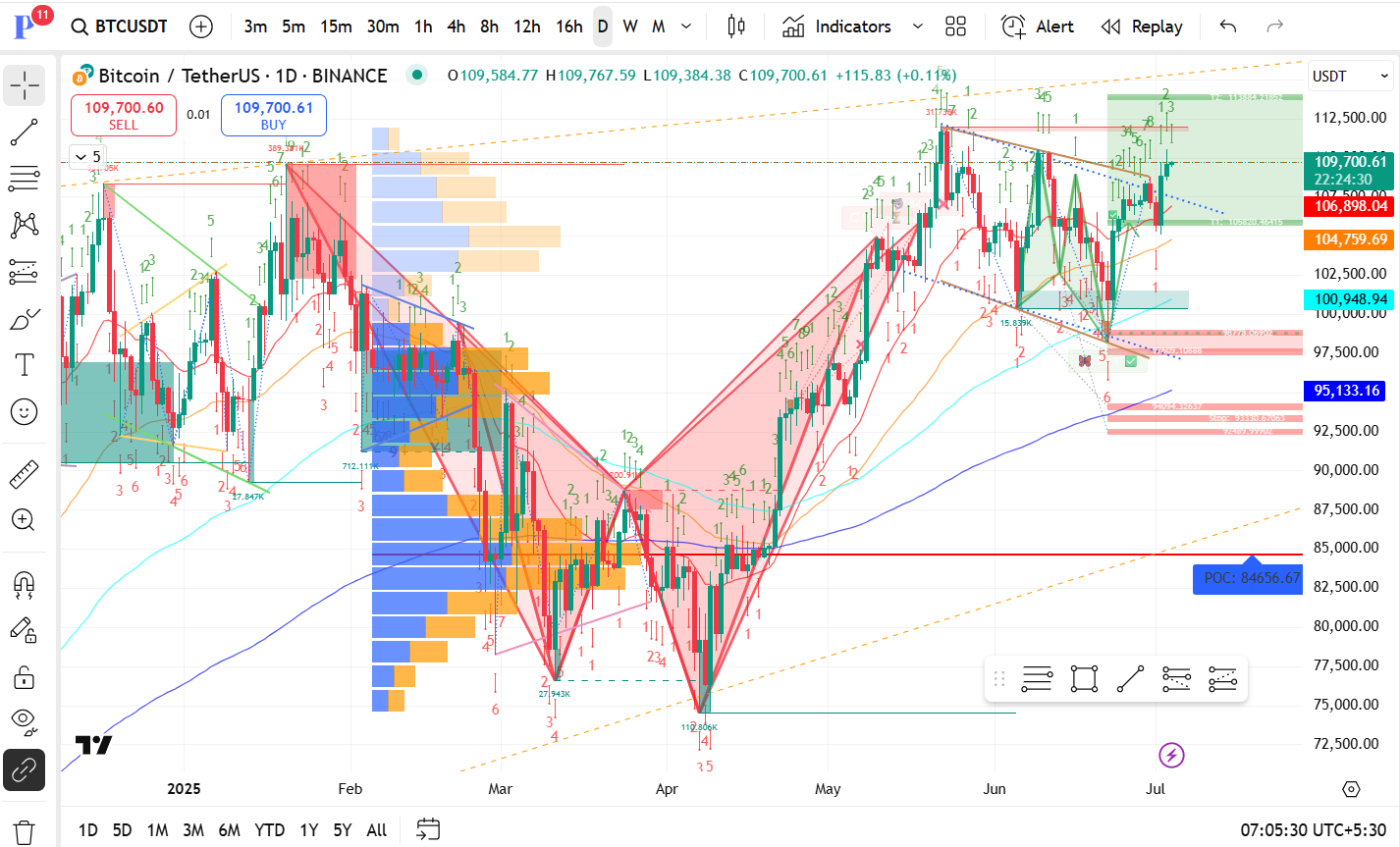

| Scenario | Target Levels | Triggers/Notes |

|---|---|---|

| Bullish Breakout (Primary Bias) | $112,500 → $115,000+ | Close above $110K with volume → new highs possible |

| Range-bound Consolidation | $106,893 → $110,000 | Possible short-term chop as price builds energy |

| Bearish Pullback | $104,757 → $100,948 | Break below $106K triggers a retest of lower supports |

| Deep Correction | $95,132 → $84,656 | Only if macro sentiment turns negative |

👉 My Take: