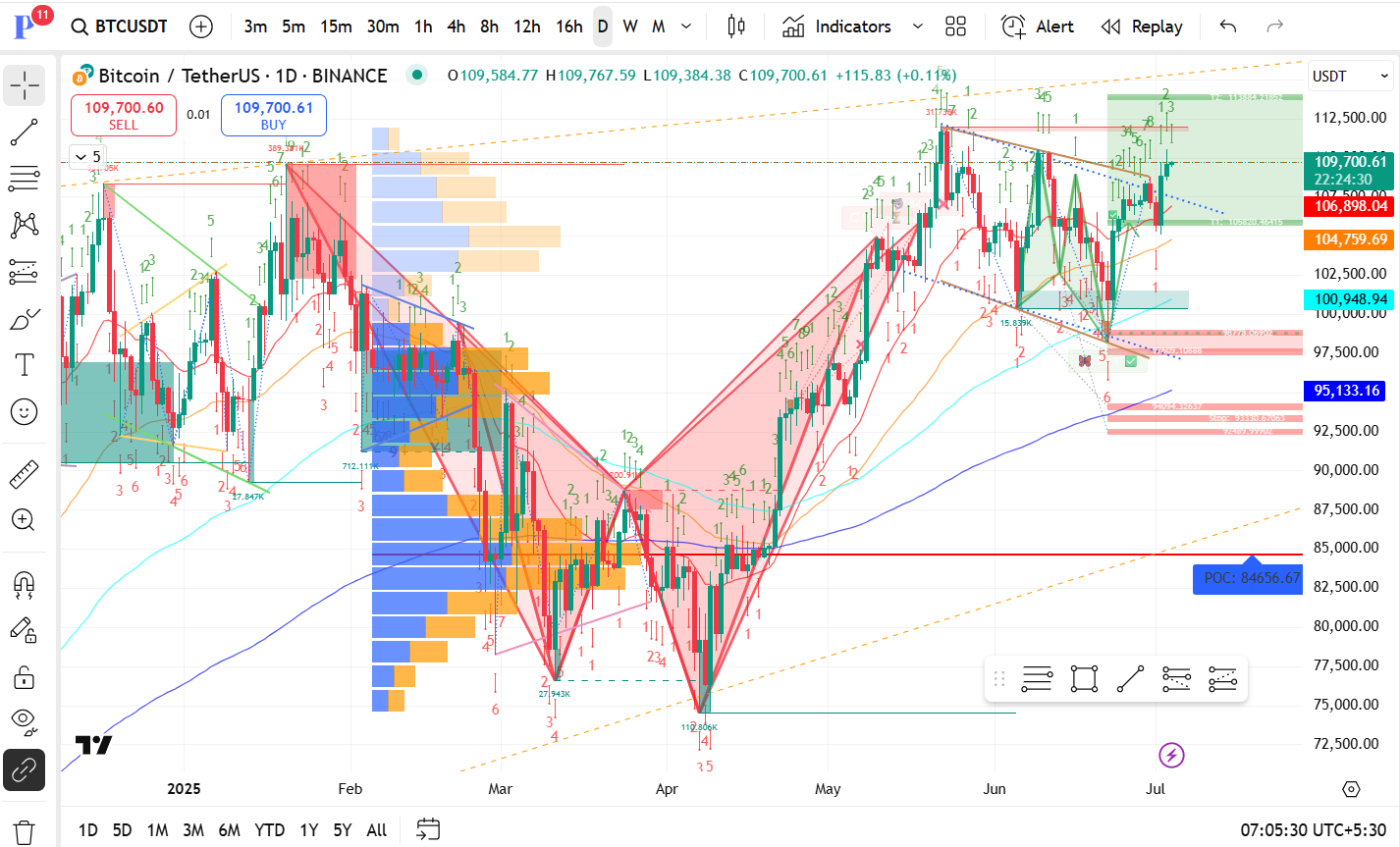

Current Price: $109,656 (as of this daily candle)

Short-Term Trend: Bullish breakout attempt from a descending triangle or wedge pattern.

Volume Profile (POC): High interest/support zone near $84,656.

Chart Patterns:

Multiple W-shaped double bottom patterns (highlighted in red) are visible, especially the strong bounce in March–April.

Recent breakout from a descending trendline with a sharp bullish move.

Bullish flag or pennant formation that’s potentially resolving upward.

Support & Resistance:

Immediate Resistance: ~$110,000 – $112,500 zone (previous highs).

Immediate Support: ~$106,893 (recent breakout area).

Next key supports:

$104,757 (strong candle base and minor demand zone).

$100,948 (psychological and structural support).

$95,132 (marked key support + 200 MA convergence).

Volume Profile Insights:

Strong historical volume concentration (blue bars) between $95,000–$100,000.

Thin liquidity above $110,000—this could lead to sharp moves in either direction.

The major POC at $84,656 remains the ultimate strong base (but far below current price).

Moving Averages:

Price is above:

50-day MA

100-day MA

200-day MA (around $95K).

The bullish alignment of moving averages confirms a strong medium-term trend.

TD Sequential & Elliott Waves:

The chart shows advanced TD counts (1–9), which can indicate trend exhaustion or continuation depending on price reaction.

The recent green counts suggest a fresh bullish leg is underway after correction.

Fibonacci Retracement:

There is a small visible Fib retracement suggesting price has cleared the 61.8% level of the previous swing down, indicating strength.

| Scenario | Target Levels | Triggers/Notes |

|---|---|---|

| Bullish Breakout (Primary Bias) | $112,500 → $115,000+ | Close above $110K with volume → new highs possible |

| Range-bound Consolidation | $106,893 → $110,000 | Possible short-term chop as price builds energy |

| Bearish Pullback | $104,757 → $100,948 | Break below $106K triggers a retest of lower supports |

| Deep Correction | $95,132 → $84,656 | Only if macro sentiment turns negative |

👉 My Take:

The chart looks bullish but approaching critical resistance.

Immediate watch zone: $110K+ breakout or $106K retest.

Keep an eye on volume spikes—low volume could mean false breakouts.