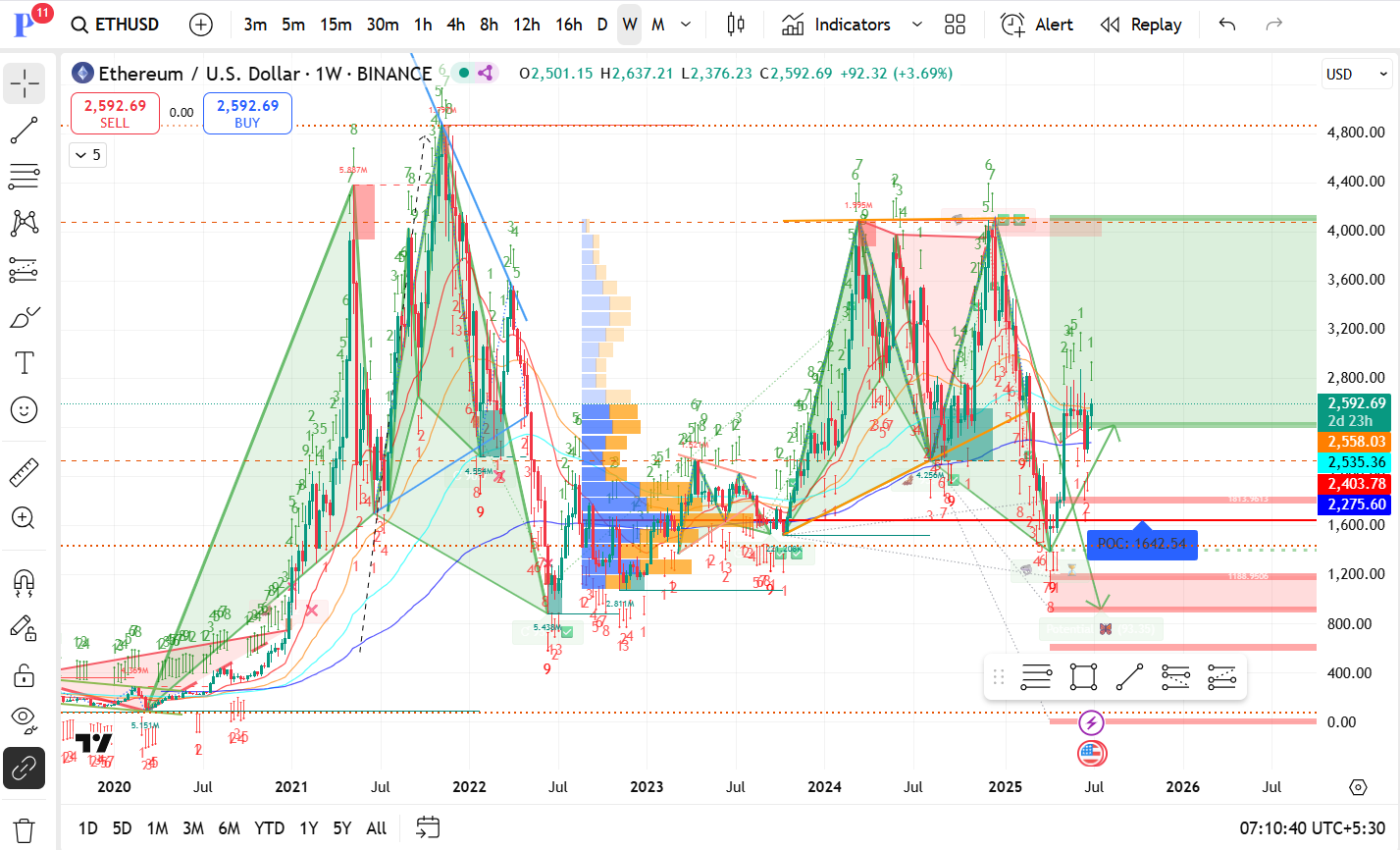

Current Price: $2,592

Trend: Attempting recovery after a major pullback.

Major Resistance Levels:

$2,800 – $3,200: Strong supply zone with multiple past rejections.

Significant congestion below $4,000, which capped previous bull runs.

Immediate Support Levels:

$2,558 (first level support—near-term stability).

$2,535

$2,403

Stronger support sits at:

$2,275 (volume cluster + structural).

POC: $1,642—This is the historical Point of Control where most trading activity has occurred.

Bearish Risk Levels (Downside Targets):

If the current bounce fails, price could revisit:

$1,600

$1,200

Extreme bear case: sub-$1,000 zone (unlikely unless a market-wide crash).

Chart Patterns:

Multiple M-shaped double tops and W-shaped double bottoms suggest a volatile but well-respected pattern structure.

Current recovery is from a higher low compared to previous major lows (positive for bulls).

TD Sequential & Elliott Wave:

Several TD 9s and 13s are visible, signaling potential exhaustion in both directions.

The current upward move looks like it could be Wave 3 or Wave 5, but still within a broader corrective context.

Fibonacci Levels:

Fib retracements show key levels aligned with historical price congestion zones.

The risk of a move back towards 61.8% retracement (near $1,200–$1,600) is still present unless bulls reclaim higher levels.

Volume Profile:

Heavy accumulation noted between $1,500 – $2,200.

Above $2,600, there’s less volume resistance, allowing faster upward movement if broken.

Moving Averages:

Price is currently:

Slightly above or testing the 50-week MA.

Below the 100-week MA and well below 200-week MA.

These MAs could act as dynamic resistance unless convincingly broken.

| Scenario | Price Targets | Trigger/Conditions |

|---|---|---|

| Bullish Breakout | $2,800 → $3,200 → $3,600+ | Strong weekly close above $2,650–$2,800 with volume |

| Sideways Accumulation | $2,275 → $2,800 range | Price consolidates between key support and resistance |

| Bearish Breakdown | $2,200 → $1,642 → $1,200 | Weekly close below $2,275 triggers deeper correction |

✅ Bulls need to reclaim $2,800–$3,000 to signal a stronger uptrend continuation.

✅ Losing $2,275–$2,400 could open up risk towards $1,600–$1,200.

✅ Macro-level resistance near ATH zones (~$4,000) is still far off but will be the next big challenge.