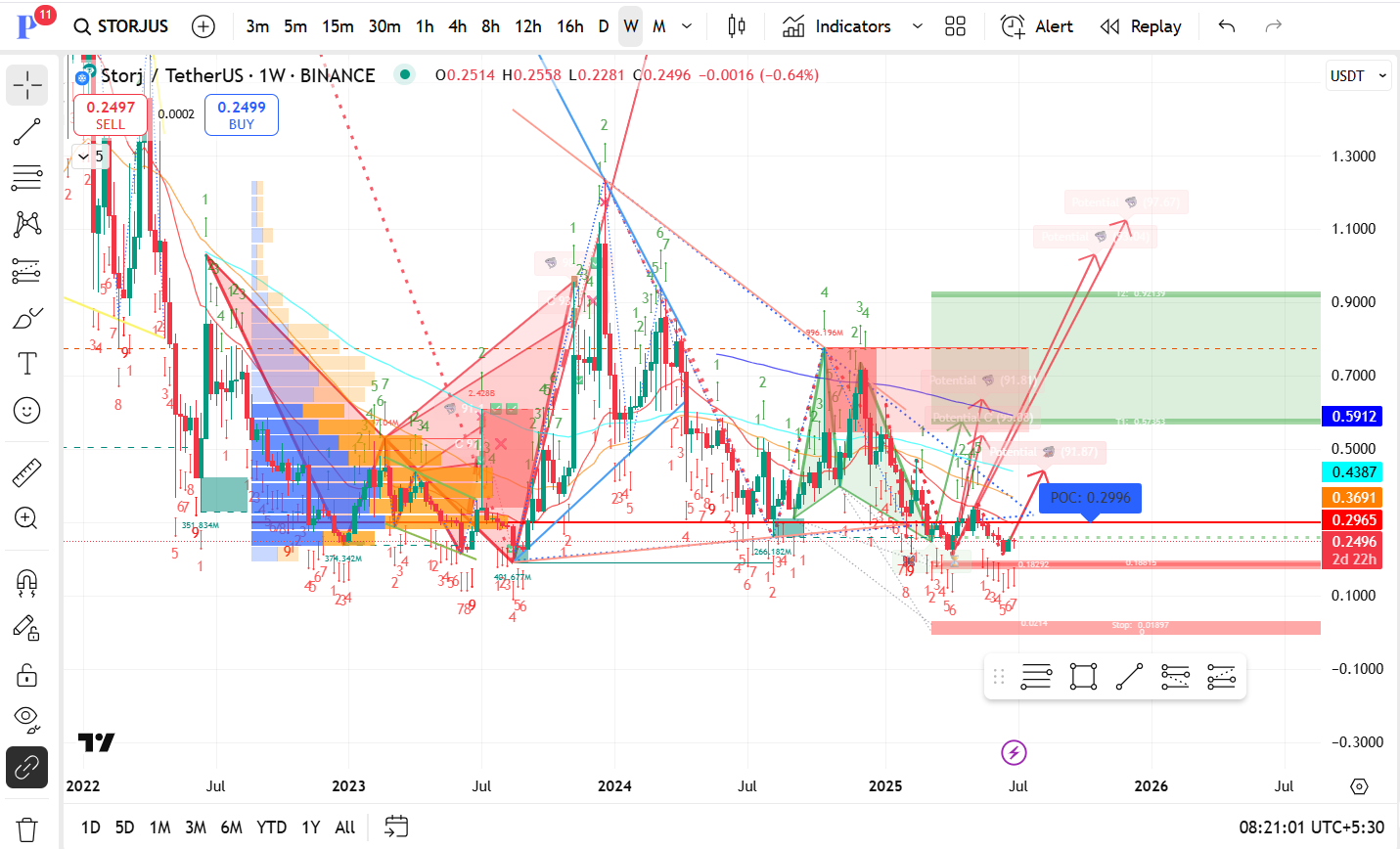

✅ Current Price: $0.2496

- Price is showing early signs of reversal from long-term bottoming.

🔑 Key Technical Highlights:

1. Support Levels:

- $0.22–$0.23: Strong base (multiple touches, long wicks).

- $0.187 (Stop Zone): Critical invalidation level—below this, the bullish structure collapses.

2. Resistance Levels:

- $0.2996 (POC): This is the key Point of Control—a magnet for price.

- $0.3691: First breakout resistance.

- $0.4387: Mid-level target.

- $0.5912: Major resistance to unlock higher levels.

3. Chart Patterns & Structure:

- Multiple double bottom formations and W-patterns are evident.

- The long descending wedge has likely resolved with a bullish bias (as per green arrows).

- Elliott Waves: Potential Wave 1 complete with Wave 2 correction—setting up for Wave 3 (strongest wave) upwards.

4. Volume Profile Insights:

- Heavy accumulation visible between $0.15–$0.30.

- Thin volume overhead means a breakout could move rapidly once above $0.40–$0.50.

5. TD Sequential:

- Sequential counts suggest exhaustion of the downtrend and early trend reversal potential.

📈 Potential Scenarios:

| Scenario | Target Zones | Trigger |

|---|

| Bullish Breakout: | $0.30 → $0.43 → $0.59 → $0.90+ | Weekly close above $0.30 with volume |

| Range-bound Accumulation: | $0.22 → $0.30 | Price holds base but lacks breakout strength |

| Bearish Breakdown: | $0.187 or lower | Break of $0.22 invalidates bullish setup |

🚀 Upside Potential (2025–2026 View):

- Base Target: $0.43–$0.59

- Stretch Target: $0.90–$1.10+

- Some long-term projections on the chart even hint at $1.80+ but that’s ambitious unless broader altcoin rally happens.

📝 Suggested Trade Plan (Swing to Mid-Term):

- Entry: $0.23–$0.25 (current zone ideal for accumulation)

- Stop Loss: $0.18

- Target 1: $0.30 (POC)

- Target 2: $0.43

- Target 3: $0.59+

- Optional Target 4: $0.90+

👉 Risk/Reward is excellent in this zone with minimal downside vs high upside.